tax forgiveness credit pa

Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability. Free Case Review Begin Online.

If your Eligibility Income.

. Ad Apply For Tax Forgiveness and get help through the process. Based On Circumstances You May Already Qualify For Tax Relief. You May Qualify to be Forgiven for Tens of Thousands of Dollars in Taxes.

Ad Get help resolving your IRS tax debts with Fresh tax Solutions. The qualifications for the Tax Forgiveness Credit are as follows. Taxpayers may only claim dependents who are minor or adult children claimed as dependents on their federal income tax returns.

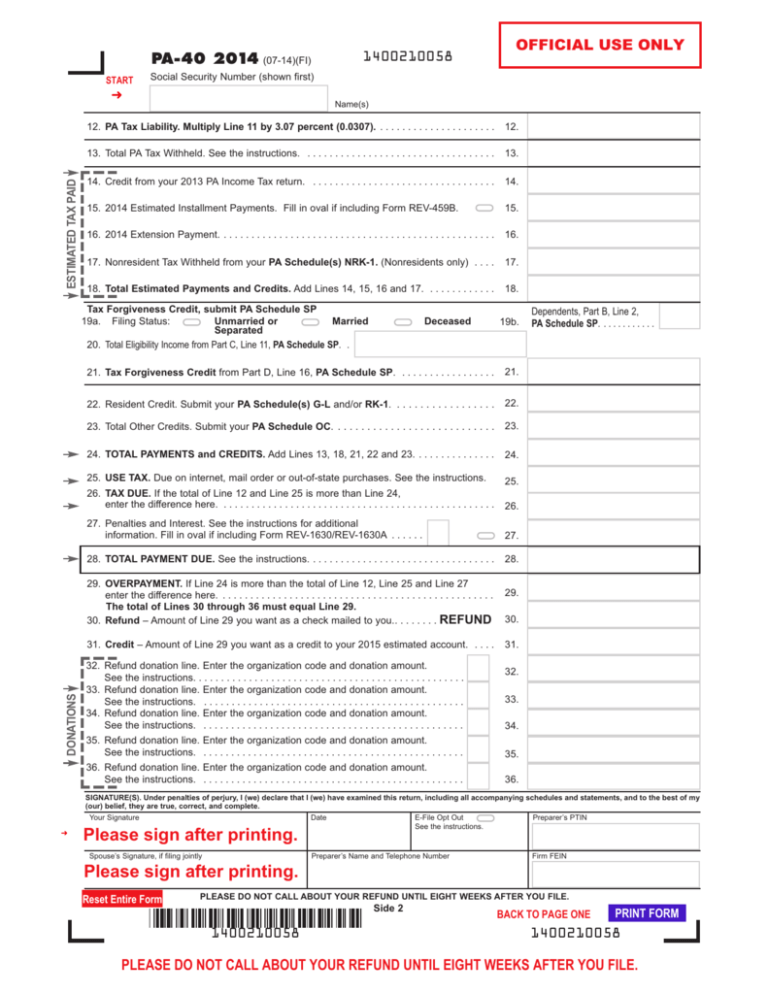

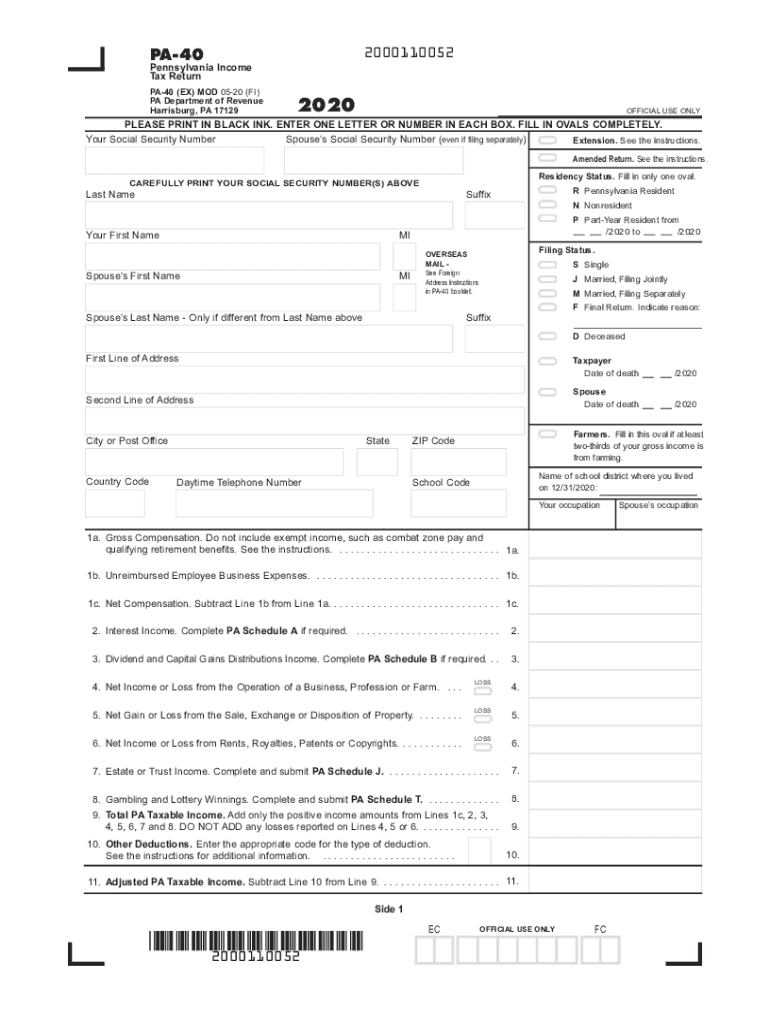

You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income. Tax forgiveness gives a state tax refund to some taxpayers and forgives some taxpayers of their liabilities even if they havent paid their Pennsylvania income tax.

Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. Ad See If You Qualify For IRS Fresh Start Program. Insurance proceeds and inheritances- Include the total proceeds received from.

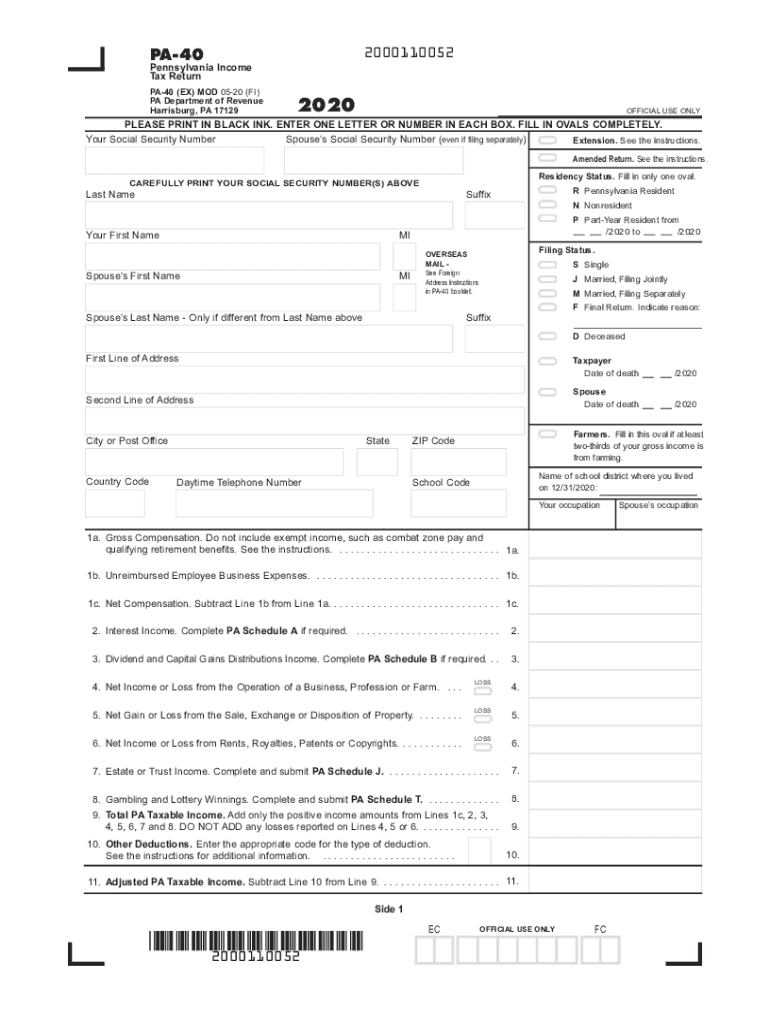

The IRS debt forgiveness. For PA purposes qualifying. To claim this credit it is necessary that a taxpayer file a PA-40.

ELIGIBILITY INCOME TABLE 1. To enter this credit within. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability.

Ad See If You Qualify For IRS Fresh Start Program. You are subject to Pennsylvania personal income tax. For more information visit the Internal Revenue Services at www.

Learn how to deduct your PA ABLE contributions on PA income taxes. Tips for Tax Forgiveness. What is tax forgiveness program.

The Mixed-Use Development Tax Credit program administered by the Pennsylvania Housing Finance Agency authorizes the Agency to sell 45 million of state tax credits to qualified. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP. What is Pennsylvania REV 419 ex.

Provides a reduction in tax. You andor your spouse are liable for Pennsylvania tax on your income. What is a Pennsylvania tax forgiveness credit.

Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA- 40 Line 12.

Ad PA ABLE provides benefits for PA residents unavailable from other states ABLE accounts. Where do I enter this in the program. The PA earned income was 9100.

S Web site at wwwirsgov or call the IRS toll-free 1-800-829. Free Case Review Begin Online. Unmarried and Deceased Taxpayers.

Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. Based On Circumstances You May Already Qualify For Tax Relief. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

However we also received 40k in Social. We provide guidance at critical junctures in your personal and professional life. Get help settling back taxes with Fresh tax Solutions.

The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA. Ad Tax Strategies that move you closer to your financial goals and objectives.

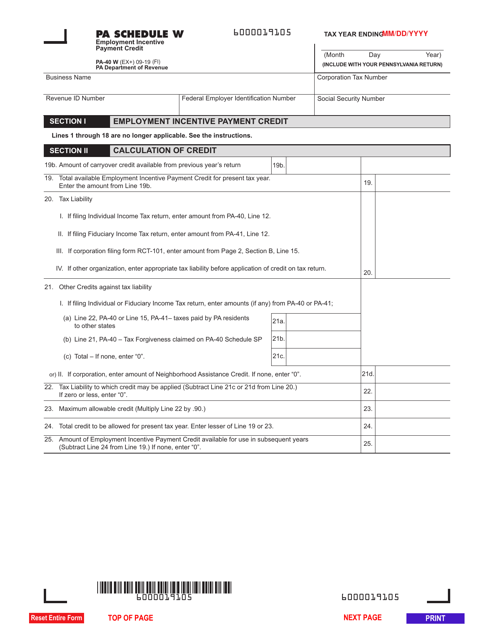

Form Pa 40 Schedule W Download Fillable Pdf Or Fill Online Employment Incentive Payment Credit Pennsylvania Templateroller

Pennsylvania State Taxes Everything You Need To Know Gobankingrates

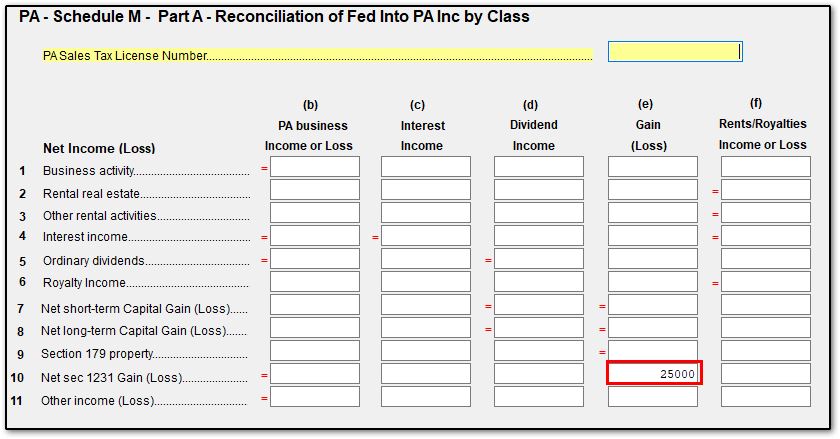

Pa Schedule M Capital Gains Scheduled Schedulem

Form Pa 40 Telefile Worksheets 2011 Pa Telefile Worksheets Personal Income Tax

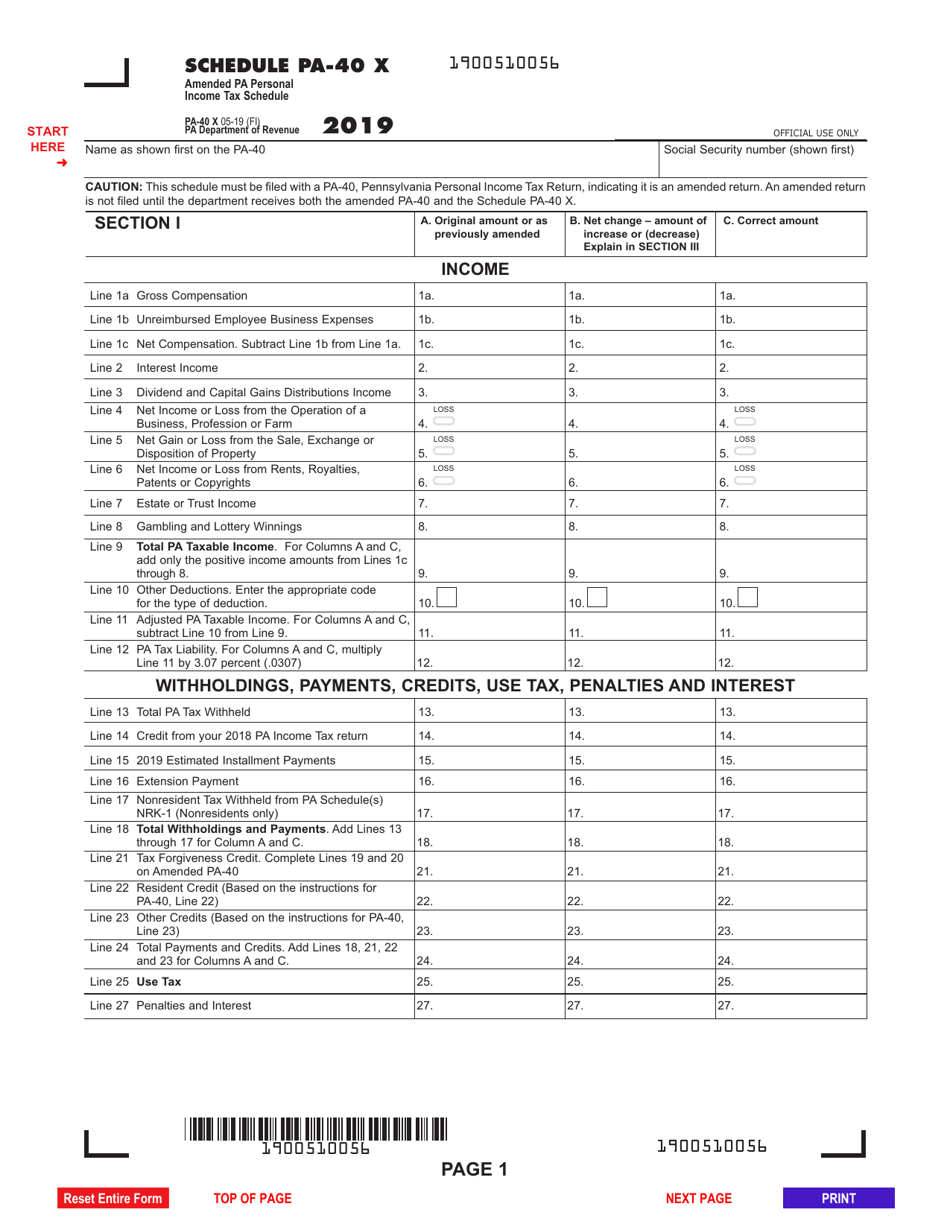

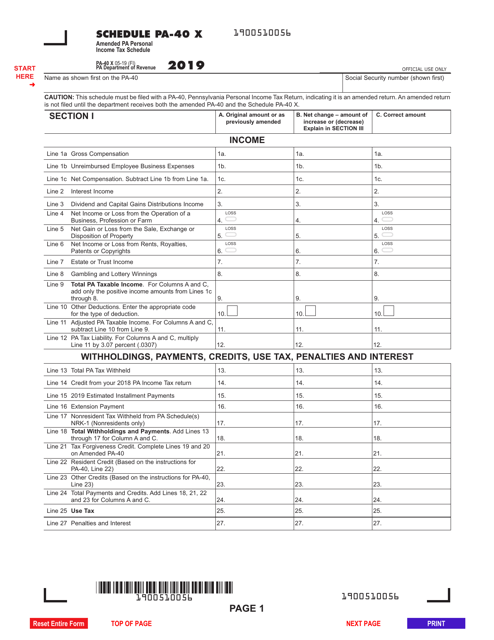

Schedule Pa 40 X Download Fillable Pdf Or Fill Online Amended Pa Personal Income Tax Schedule 2019 Pennsylvania Templateroller

Schedule Pa 40 X Download Fillable Pdf Or Fill Online Amended Pa Personal Income Tax Schedule 2019 Pennsylvania Templateroller

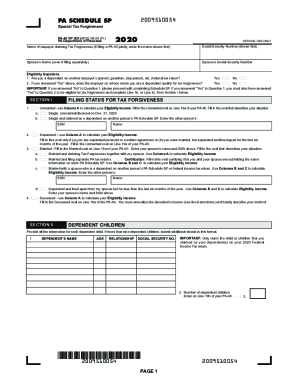

Pa Schedule Sp Form Fill Out And Sign Printable Pdf Template Signnow

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

Pa Dor Pa 40 2020 Fill Out Tax Template Online Us Legal Forms

Pa Tax Update Good News For Taxpayers In 912m Pandemic Relief Bill